Retail giant Walmart (NYSE:WMT) will announce its Q2 financials on August 16. While inflation and excess inventory issues could continue to impact Walmart’s performance, TipRanks’ website traffic tools show improving trends. It remains to be seen whether Q2 results will be similarly strong, or whether the reduced Q2 earnings guidance portended poor earnings results.

Rising Web Visit Trends for Walmart

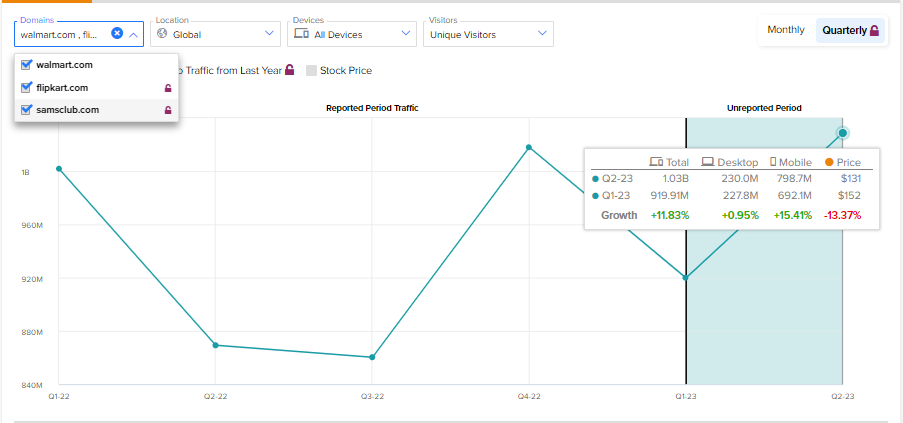

According to the TipRanks’ website traffic tool, the momentum in Walmart’s e-commerce business has been sustained. Per the tool, the number of visits to walmart.com and its two other websites increased 11.83% quarter-over-quarter in Q2. Further, on a year-over-year basis, traffic has grown by 26.43%.

This is in line with management’s recently updated guidance for Q2. Walmart recently announced that Q2 comparable sales (for Walmart U.S., excluding fuel) would grow by 6%, compared to its earlier guidance of a 4-5% increase.

The increase in guidance comes from a higher mix of food and consumables in the overall sales. Also, it reflects the growing penetration of e-commerce sales.

Learn how Website Traffic can help you research your favorite stocks.

WMT’s Margins to Remain Low

While improving traffic trends are encouraging and hint that WMT’s sales could improve, the growing mix of food and consumables (low margin products) will likely weigh on its margins. Further, higher markdowns to clear excess inventory will also hurt margins.

WMT’s CEO Doug McMillon stated, “The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars.”

Given the margin pressure, Walmart reduced its Q2 earnings guidance. WMT expects Q2 adjusted EPS to decline by 8-9%. This compares unfavorably to its previous forecast, wherein it said the Q2 EPS could stay flat or improve slightly.

Is Walmart a Good Stock to Buy Now?

Many analysts consider Walmart a good stock to buy. Despite the short-term challenges, improving web traffic numbers indicate that Walmart’s digital strategy resonates well with consumers. This is positive and could position WMT well to capitalize on the ongoing digital shift.

Highlighting WMT’s digital strategy, Guggenheim analyst Robert Drbul stated, “We expect WMT to continue to benefit from increasing digital penetration. WMT continues to scale offerings profitably, and we are impressed with sustained e-commerce growth and share gains. We believe its position of strength is enabling WMT to accelerate investments in its infrastructure and should allow full optimization of its strategy, in turn accelerating WMT’s top line and profit growth rates in the mid to long term.”

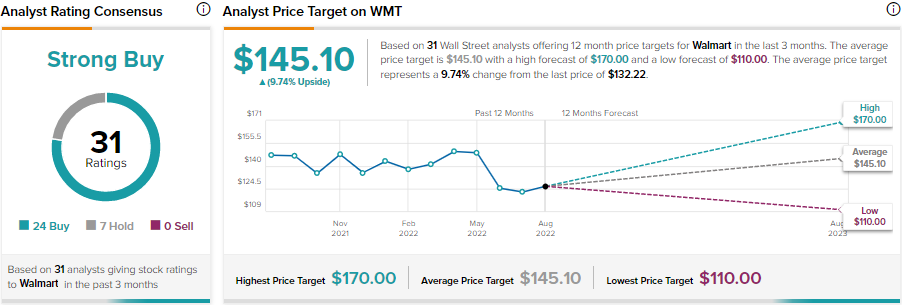

Drbul is bullish about WMT stock, and his price target of $155 implies 17.2% upside potential. Including Drbul, WMT stock has received 24 Buy and seven Hold recommendations for a Strong Buy rating consensus. Further, analysts’ average price target of $145.10 implies 9.7% upside potential.

At the same time, in-store visits did not necessarily increase along with digital visits, so the enhanced digital aspects of Walmart might not lead to better overall financial results.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Digital Marketing – My Blog https://www.techyrack.com/syndication/2022/08/15/walmart-stock-website-traffic-shows-rising-trends-for-q2-tipranks/

via IFTTT

No comments:

Post a Comment