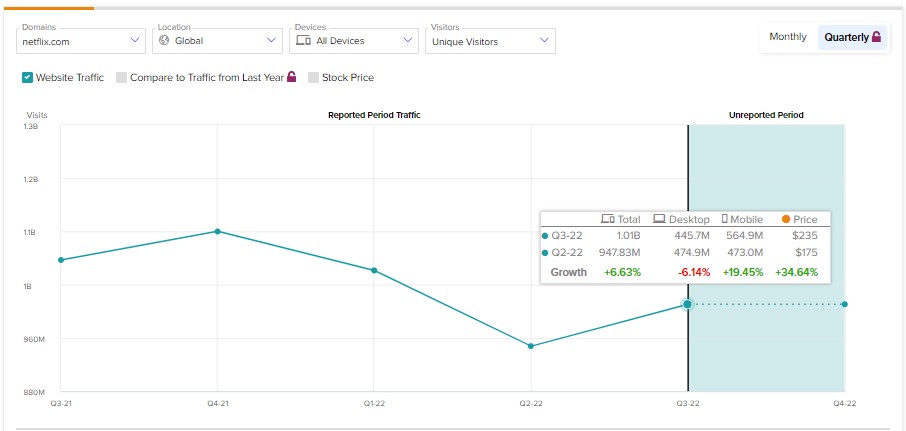

Netflix (NASDAQ:NFLX) delivered impressive financial and operating numbers for the third quarter. However, this shouldn’t surprise TipRanks’ users who leverage our website traffic screener. TipRanks’ website traffic screener showed that Netflix’s web visits are rising, indicating higher user engagement that could translate into subscriber growth in Q3.

Per the tool, the web visits to netflix.com were up 6.63% quarter-over-quarter in Q3. Given the rise in traffic, Netflix announced that it had higher engagement than its peers and accounted for more TV time.

According to the company, Netflix accounts for 7.6% of TV time in the US, roughly 2.6 times more than Amazon (NASDAQ:AMZN) and 1.4 times higher than Disney+. Further, NFLX accounts for 8.2% of video viewing in the U.K., about 2.3 times higher than Amazon and 2.7 times more than Disney+.

Thanks to the higher engagement, Netflix added 2.41 million paid subscribers in Q3, much higher than its guidance of 1 million. What stands out is its stellar performance in the APAC (Asia Pacific) region. Netflix added 1.43 million paid subscribers in Q3, outperforming other regions by a wide margin.

It’s worth highlighting that for Netflix, our website traffic prediction has been correct for three consecutive quarters. In Q2, our website traffic screener correctly predicted that Netflix would lose subscribers, owing to which its revenue fell short of analysts’ estimates.

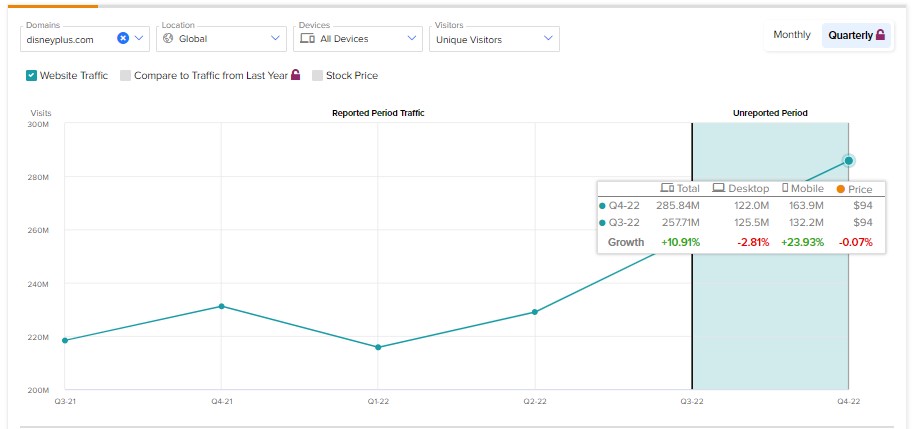

While Netflix bounced back in Q3, let’s leverage TipRanks’ website traffic screener to gauge what’s on the horizon for Disney+ in the fourth quarter.

Website Traffic Shows Rising Trends for Disney+

For Disney+, a leading subscription-based streaming service from Disney (NYSE:DIS), the tool shows that web visits are rising, pointing to a continued improvement in demand. The data shows that traffic at disneyplus.com increased 10.91% quarter-over-quarter in Q4.

Notably, Disney+ added 14.4 million subscribers during the last reported quarter.

The web visit trends show that Disney could continue to add more subscribers in Q4. Disney will announce its Q4 results on November 8.

Learn how Website Traffic can help you research your favorite stocks.

Bottom Line

With saturation in developed markets and increased competition, streaming service providers face an uphill task of getting a greater share of users’ wallets. Thus, our web traffic screener comes in handy to gain insights about what will happen ahead of the earnings report.

Meanwhile, on TipRanks, Netflix stock has a Hold consensus estimate based on 10 buy, 14 Hold, and five sell recommendations. An adverse currency movement and higher content and marketing spending could weigh on its revenues and operating margins in the near term.

On the contrary, Disney stock has received 14 Buy and three Hold recommendations for a Strong Buy consensus rating. The rising web traffic trends indicate that Disney’s revenues could zoom past estimates in the upcoming fourth quarter.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Digital Marketing – My Blog https://www.techyrack.com/syndication/2022/10/19/netflix-outperformedwhat-about-disney-tipranks/

via IFTTT

No comments:

Post a Comment